Depreciation

Assets are broadly divided in to two categories - current assets (cash, debtors or customers balances, stock of materials and goods) and fixed assets (buildings, furniture and fixtures, machinery and plant, motor vehicles).

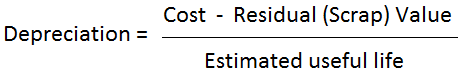

Fixed assets are also called long term assets as they provide benefits to the business for more than one year. Most fixed assets loose their value over time as these are put in use and as the years pass by. The fixed assets loose their usefulness due to arrival of new technologies and other reasons. These are then generally required to be replaced, as their useful life is over. Hence, the cost of a fixed asset is allocated over its useful life. Each year’s allocation of the cost is charged as depreciation expense for that year.

For example, an office chair is purchased for INR 2,500 and it is estimated that after ten years it will be scraped. The useful life of the chair is ten years over which the cost of INR 2,500 will be distributed.

Thus, INR 250 is the depreciation expense for each year.

Causes of Depreciation

Depreciation is an expense charged during a year for the reduction in the value of fixed assets, arising due to:

- Normal wear and tear out of its use and passage of time

- Obsolescence due to change in technology, fashion, taste and other market conditions

Normal wear and tear

(a) Due to usage - Every asset has a life for which it can run, produce or give service. Thus, as we put the asset to use its worth decreases. Like decrease in the efficiency and functioning of a bicycle due to its running and usage.

(b) Due to passage of Time - As the time goes by elements of nature, wind, sun, rain, etc, cause physical deterioration in the worth of an asset. Like reduction in the worth of a piece of furniture due to passage of time even when it is not used.

Obsolescence

(a) Due to development of improved or superior equipment - Sometimes fixed assets are required to be discarded before they are actually worn out. Arrival of superior equipments and machines, etc. allow production of goods at lower cost. This makes older equipments worthless as production of goods with their use will be costlier and non competitive. For example, Steam engines became obsolete with the arrival of diesel and electric locomotives.

(b) Due to change in fashion, style, taste or market conditions - Obsolescence may also result due to decline in demand for certain goods and services with a change in fashion, style, taste or market conditions. The goods and services that are no longer in vogue lead to decrease in the value of the assets which were engaged in their production - like factories or machines meant for making old fashioned hats, shoes, furniture, etc.

Objectives of Depreciation

To show the True Financial Position of the Business

As Fixed Assets have some effective working life during which it can be economically operated, depreciation is the gradual loss in the value of fixed assets. If depreciation is not provided, profit and loss A/c will not disclose the true profit made during the accounting period. At the same time, the Balance Sheet will not disclose the true Financial position as fixed assets appearing in the Balance Sheet will be over valued. If depreciation is ignored year after year, ultimately when asset is worn out, the proprietor will not be is a position to continue the business smoothly.

To retain funds in the business for replacement of the asset

Net profit is the yield of the capital invested by proprietor and may be wholly withdrawn in the form of cash. If depreciation is provided, this figure of net profit will be reduced and the amount withdrawn by the proprietor will also be decreased. As such the cash equivalent to the change for depreciation will be left over the business. This accumulated amount will enable the proprietor to replace a new asset.

Factors Affecting Depreciation

Following are the factors that affect the amount of depreciation of an asset.

- Cost of Asset: Cost of asset is the purchase price of the asset and includes all such expenses which are incurred before it is first put to use. For example, expenses on loading, carriage, installation, transportation and unloading of the asset up to the point of its location, expense on its erection and assembly.

- Useful Life of the Asset: Useful life is the expected number of years for which the asset will remain in use.

- Scrap Value: Scrap value is the residual value at which the asset could be sold to scrap dealer (Kabari) after its useful life.

- Depreciable value of asset: Depreciable value is the cost of asset minus the scrap value.